Remember the time when teacher used to tell us to maintain a balance between academic life and extracurricular activities, doctors always suggest us to take a balanced diet for proper nutrition, we as humans always try to maintain a balance between our social and personal life. We do so, because balance is directly proportional to the productivity of ourselves in all aspects. But, why we often forget to choose a mutual fund that keeps a balance between asset classes.

Not anymore, as aggressive hybrid funds diversify the assets in a combination of debt and equities with a mandate exposure of 65%-80% in the equity market. And, the best mutual fund among all is Aditya Birla Sun Life Equity Hybrid ‘95 Fund.

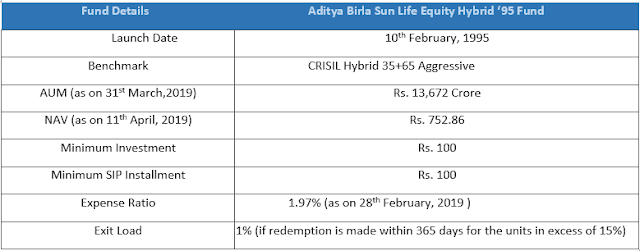

Fund Details:

Investment Style:

Being an aggressive fund, Aditya Birla Sun Life Equity Hybrid ‘95 Fund invests in a combination of equity and debt instruments. In the equity market, the scheme follows a growth-oriented investment style and ploughs the money predominantly in the large cap companies. Moreover, in case of debt instruments, the aggressive hybrid fund picks high credit quality instruments having medium interest rate sensitivity. Below is the detailed portfolio analysis of Aditya Birla Sun Life Equity Hybrid ‘95 Fund.

Allocation of Assets:

The aggressive hybrid fund of ABSL invests 75.61% of the assets in the stocks of different market caps and the remaining 24.1% is allocated to the debt instruments. This distribution of the assets has helped the scheme in utilizing the benefits of equities and debt instruments. Thus, this scheme is a perfect choice for the candidates who want to enjoy healthy returns of equities and stability of debt instruments.

Allocation of Sector: The financial sector like any other scheme of ABSL, occupies the largest percentage of allocation, i.e, 26.79%, followed by other sectors like, FMCG (7.13%), technology (6.82%), healthcare (6.47%), construction (5.98%), energy (5.84%), etc.

Aditya Birla Sun Life Equity Hybrid ‘95 Fund: Promising Track Record

Th previous track record of the scheme has been very promising. The 5,7, and 10-year annualized returns of this aggressive fund are 13.68%, 13.88%, 16.12%, respectively. The figures indicates the trust that this scheme has payback to its investors in terms of returns. Also, according to the financial experts of MySIPonline, if positive sentiments continue to persist in the finance market, then this scheme has all the capabilities to provide even more attractive returns.

Who Should Invest in Aditya Birla Sun Life Equity Hybrid ‘95 Fund?

Investors With Moderately High Risk Appetite- The scheme has more than 65% of assets invested in the equities which makes it more prone to risk. Although the fund managers are capable enough to implement the best investment strategy but uncertainty in the market can land your money to risk anytime. Furthermore, never forget to maintain a long-term investment prospective while investing in this aggressive hybrid scheme of ABSL.

Reading so far, you must have understood that there is no aggressive hybrid fund better than Aditya Birla Sun Life Equity Hybrid ‘95 Fund. However, if you still need any further suggestions regarding the mutual fund market, then feel free to contact our financial experts at- www.mysiponline.com, you can also download our Android mobile app for further assistance.